Intapp (INTA)·Q2 2026 Earnings Summary

Intapp Beats on All Metrics, Stock Plunges 29% After Hours

February 3, 2026 · by Fintool AI Agent

Intapp (NASDAQ: INTA) reported Q2 FY2026 results that beat expectations across the board, yet the stock is down sharply in after-hours trading. The AI-powered professional services software provider posted revenue of $140.2M (+16% YoY) and Non-GAAP EPS of $0.33 (+57% YoY), both exceeding street estimates. Cloud ARR accelerated to 31% YoY growth, reaching $433.6M and representing 81% of total ARR.

Despite the strong results, INTA shares closed down 11% in regular trading at $29.31 and fell further to $23.95 in after-hours trading — a 29% decline from the prior close of $33.64. The disconnect between fundamentals and price action may signal concerns about capital allocation after the company spent $150M on buybacks, depleting cash reserves significantly.

Did Intapp Beat Earnings?

Yes — decisively. Intapp beat on both revenue and EPS, extending its streak of consecutive beats.

The company also beat its own guidance from Q1: management had guided Q2 revenue of $137.6-138.6M and EPS of $0.25-$0.27. Actual results came in well above the high end of both ranges.

What Were the Key Growth Drivers?

Cloud ARR Acceleration

Cloud ARR reached $433.6M, up 31% YoY — an acceleration from 29% in Q4 FY25. Cloud now represents 81% of total ARR, up from 76% a year ago, demonstrating successful cloud migration.

SaaS Revenue Growth

SaaS revenue grew 28% YoY to $102.5M, maintaining strong momentum. This was the first quarter SaaS revenue exceeded $100M.

Net Revenue Retention

Cloud NRR of 124% shows strong expansion within the existing customer base. The company now serves 2,750+ clients with 834 contracts above $100K ARR.

Operating Leverage

Non-GAAP operating income grew to $27.7M from $18.9M in Q2 FY25 — a 47% YoY increase on 16% revenue growth. Non-GAAP operating margin expanded significantly.

What Did Management Guide?

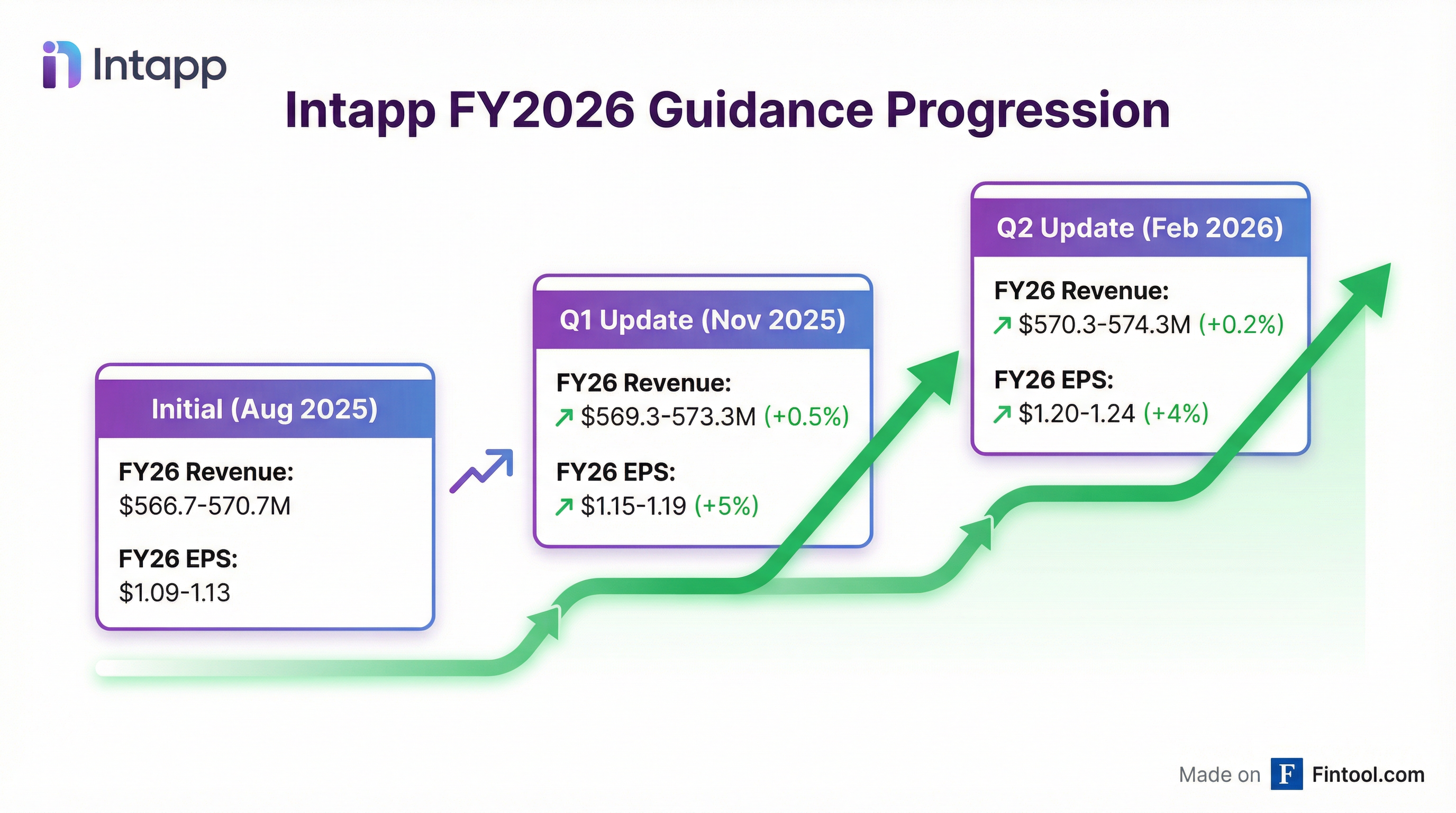

Management raised full-year guidance modestly while guiding Q3 above consensus:

FY26 revenue guidance of $570-574M implies ~13% growth at the midpoint, a slight deceleration from the 16% Q2 growth rate. EPS guidance of $1.20-1.24 was raised from $1.15-1.19 last quarter.

Note on Q3: Management called out that Q3 guidance includes incremental spend for "targeted marketing campaigns associated with our upcoming product showcase at Intapp Amplify as well as targeted investments to increase the rate of pace of delivery on our AI suite of offerings."

How Did the Stock React?

Sharply negative — despite the beat.

The stock hit new 52-week lows during today's session. At $23.95, INTA trades at roughly 4x forward revenue — a significant compression from its historical multiple.

The disconnect between strong fundamentals and negative price action may reflect:

- Aggressive buyback: $150M spent on repurchases reduced cash from $313M to $191M

- Valuation reset: Stock had run up significantly before earnings

- Broader market: Tech selloff context

What Changed From Last Quarter?

Key improvements: Cloud ARR growth accelerated, NRR expanded 300bps, and operating margins improved significantly. The main concern is the cash burn from buybacks.

Revenue Trend Analysis

Revenue growth has been decelerating slightly from 18% to 16% YoY. SaaS revenue growth remains robust at 28% YoY but is also moderating from 30%+ levels in prior quarters.

Margin Progression

Non-GAAP operating margin jumped to 19.8% this quarter — a significant expansion reflecting operating leverage as SaaS scales.

Balance Sheet & Capital Allocation

The company repurchased 3.4 million shares for $150.1M in H1 FY26 at an average price of ~$44/share. With the stock now at $24, this buyback appears poorly timed.

New $200M Buyback Authorization: In January 2026, the board authorized an additional $200M share repurchase program, reflecting continued confidence in long-term value. Management noted the focus is on anti-dilution measures and offsetting equity compensation dilution.

Key Business Highlights

Partner Ecosystem Driving Growth

Partners were directly involved in 7 of 10 largest deals this quarter. Microsoft remains a major growth driver — more than half of the largest wins were jointly executed with Microsoft, with Microsoft even contributing Azure investment dollars to accelerate deals. Service partner certifications rose 35% YoY, and the company now has 145+ curated data, technology, and services partners.

New Client Wins This Quarter

Legal Vertical:

- Ropes & Gray chose compliance solutions via Azure Marketplace with Microsoft investment dollars

- Am Law 30 firm added compliance solutions and migrated Time to cloud

- FordHarrison and an Am Law 100 firm moved off legacy systems to DealCloud

- Reed Smith, Holding Redlich (Australia), and Netherlands-based firm chose AML solutions

- Seyfarth Shaw and Burr & Forman added Intapp Time

Accounting Vertical:

- One of the largest US public accounting firms deepened investment in Employee Compliance

- BKL and Gravita replaced legacy systems with Intapp Collaboration

- Top UK accounting firm chose DealCloud for relationship management

Financial Services:

- Prestigious boutique investment bank chose DealCloud for banker advisory business

- Meridian Capital selected DealCloud for deal origination and forecasting

- Neuberger Berman moved from legacy CRM to DealCloud

Real Assets:

- Smith Douglas replaced multiple legacy systems with DealCloud

- Leading mixed-use and multifamily housing developer adopted DealCloud

Product Updates

- 70+ new AI capabilities added to DealCloud platform, including real-time InfoSec monitoring and personalized data insights

- Intapp Time new release driving cloud migrations with large Am Law firms

- Intapp Assist seeing strong uptake across users at all levels

Q&A Highlights

On Anthropic and AI Competition

When asked about Anthropic's open-source legal plugins, CEO John Hall emphasized Intapp's differentiated focus: "We focused on the senior leadership of the firm, how to help them grow their business... The compliance of how the firms do business and operate internally... We are not really in this space [contract review] although it is very complementary to what we do."

He added that firms are approaching Intapp for "a whole compliance infrastructure for the agents and everything to help them succeed as they deploy these different use cases."

On AI Adoption and Value Creation

Hall explained what's driving Intapp Assist adoption: "With the right AI and agentic setup you can bring a universe of information to each person... that would have been cost prohibitive to try to assemble with a human universe of researchers."

On NRR Expansion

CFO Dave Morton attributed the 300bp NRR improvement to: "Our enterprise motion is working... We also oriented around successful talk tracks about our partner ecosystem... it was both upsell and cross-sell that we're seeing good uptake."

On Microsoft Partnership Value

On whether Microsoft accelerates deal cycles: "They are shortening the sales cycle when the folks already have a Microsoft minimum Azure spend commitment in place... We've actually won some very large business from some firms that are brand new to us that came to us through an introduction or a relationship with Microsoft."

On Pricing Models

Hall noted Intapp has flexibility: "We do have today multiple pricing models in the business... we do have part of the business a historical per-user model... But we also have today a firm-based pricing model for enterprise agreements."

Upcoming Catalyst: February Investor Day & Intapp Amplify

Hall called the upcoming release "the single largest release that we've ever done... the most consequential release that the company is setting up to bring to everybody." Early responses from the ambassador and advisory board programs have been highly positive.

Forward Catalysts & Risks

Catalysts

- February Investor Day & Intapp Amplify: Management's "most consequential release ever" expected to showcase AI innovations

- M&A tailwind in accounting: PE investments transforming accounting partnerships into corporations, driving modernization demand

- Continued cloud migration (81% → 90%+ over time)

- AI product adoption driving upsells

- Enterprise client expansion (834 clients >$100K, up from 728 a year ago)

- Microsoft Azure Marketplace acceleration shortening deal cycles

- International growth: wins in Netherlands, Australia, UK this quarter

Risks

- $200M additional buyback authorized despite stock at 52-week lows

- Q3 guidance includes incremental spend for Intapp Amplify marketing and AI investments

- Revenue growth deceleration (16% → 13% implied in FY26 guidance)

- Concentration in legal/advisory verticals

- Competition from larger enterprise software vendors and emerging AI tools

The Bottom Line

Intapp delivered a strong Q2 with beats on every metric, Cloud ARR acceleration to 31% YoY, and improving operating leverage. The company raised full-year guidance and continues executing well on its cloud transition. The partner ecosystem — particularly Microsoft — is proving to be a durable growth driver, with 7 of 10 largest deals involving partners this quarter.

Looking ahead, the February Investor Day and Intapp Amplify event could serve as a catalyst, with management teasing the company's "most consequential release ever." However, the 29% stock decline suggests the market is concerned about capital allocation (another $200M buyback authorized despite stock at lows) and potential growth deceleration ahead. At ~4x forward revenue, valuation has compressed significantly — creating potential opportunity if AI monetization accelerates.

Explore More: